QuickBooks Payroll is a well-liked pay processing software program due to its full-service payroll, well-rounded options, and quick syncing with the QuickBooks accounting system. Nevertheless, it has restricted HR instruments and could be expensive to make use of, relying on the plan you get. In the event you’re searching for a QuickBooks Payroll different that prices much less, handles international worker funds, or presents extra HR options, listed here are some choices you may think about.

1

Deel

Staff per Firm Measurement

Micro (0-49), Small (50-249), Medium (250-999), Massive (1,000-4,999), Enterprise (5,000+)

Any Firm Measurement

Any Firm Measurement

Options

24/7 Buyer Assist, API, Doc Administration / Sharing, and extra

High QuickBooks Payroll alternate options comparability

These alternate options to QuickBooks Payroll, together with QuickBooks, supply tax reporting and submitting help, computerized pay computations, advantages administration, and important instruments to handle worker info.

| Beginning month-to-month value | Separate contractor plan (per thirty days) | International payroll instruments | Time monitoring | |

|---|---|---|---|---|

| QuickBooks Payroll | $50 base price + $6 per worker | $15 for as much as 20 employees + $2 per extra employee | No | Included in greater tiers |

| Gusto | $40 base price + $6 per worker | $35 base price + $6 per employee | Sure | Included in greater tiers |

| OnPay | $40 base price + $6 per worker | No | No | Through integrations |

| Sq. Payroll | $35 base price + $6 per worker | $6 per employee | No | Sure |

| Paychex Flex | Customized | No | No | Paid add-on |

| RUN Powered by ADP | Customized | No | Sure | Paid add-on |

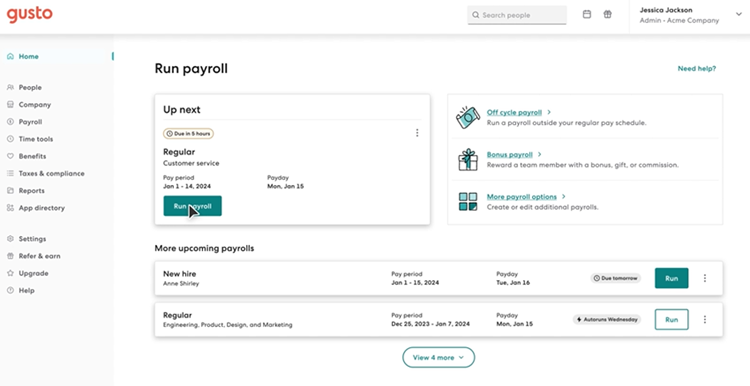

Gusto: Greatest total

As a payroll software program, Gusto has most of the similar perks as QuickBooks, comparable to computerized wage and tax computations, wage garnishments, and automatic tax filings. Nevertheless, it has a broader vary of HR options to streamline the worker lifecycle. It could possibly publish jobs, onboard employees, observe attendance, plan work shifts, and monitor efficiency critiques.

Gusto may pay worldwide contractors in over 120 international locations. And with its employer of document (EOR) service, Gusto International, it might probably compliantly rent and pay employees in Australia, Brazil, Canada, Germany, India, Eire, Mexico, the Netherlands, the Philippines, Portugal, the UK, and Spain (as of this writing).

Pricing

QuickBooks Payroll and Gusto supply three plans, however Gusto’s starter tier is barely cheaper. It solely prices $40 plus $6 per worker month-to-month, whereas QuickBooks Payroll’s starter plan is priced at $50 plus $6 per worker month-to-month. Plus, Gusto’s starter tier has extra HR options, comparable to primary paid day off (PTO) insurance policies, {custom} supply letter templates, and onboarding checklists.

Listed below are its pricing plans:

- Easy: $40 base price per thirty days plus $6 per worker per thirty days.

- Plus: $80 base price per thirty days plus $12 per worker per thirty days.

- Premium: $180 base price per thirty days plus $22 per worker per thirty days.

It additionally presents a contractor plan when you solely pay contract employees.

- Contractor solely: $35 base price per thirty days plus $6 per employee month-to-month.

Whereas Gusto’s contractor plan isn’t as inexpensive as QuickBooks Payroll’s ($15 month-to-month for as much as 20 employees plus $2 per extra employee), Gusto consists of new rent reporting in its bundle. This will prevent time, particularly if your corporation is situated in California or a state that requires firms to report newly employed contract employees.

Gusto execs and cons

| Professionals | Cons |

|---|---|

|

|

When to decide on Gusto over QuickBooks Payroll

Gusto is my prime QuickBooks Payroll different primarily due to its feature-rich platform. It’s nice in order for you a payroll system that may handle hiring to onboarding duties with ease. QuickBooks doesn’t have an applicant monitoring system (ATS) to observe candidates, and its onboarding options aren’t as intensive. With Gusto, you may observe candidates, create digital welcome playing cards for brand new hires, handle e mail and software program entry, and run background checks through Checkr straight from its platform.

Relating to payroll taxes and tax filings, each will calculate federal, state, and native taxes, however solely Gusto consists of tax cost and submitting help throughout all ranges in its starter tier. With QuickBooks, you should improve to not less than its Premium plan to get automated native tax submitting providers.

Gusto’s functionalities additionally prolong past simply processing US and international payroll. It could possibly assist with state tax registration and presents an R&D tax credit score service that permits you to save as much as $250,000 in payroll taxes annually. So, between options and pricing, I think about Gusto the highest different to QuickBooks Payroll for many small companies.

Be taught extra about Gusto

OnPay: Greatest worth for cash

What units OnPay aside from QuickBooks Payroll and the others on my record is its flat-rate pricing. You solely get one plan, with all its options and providers included in that bundle. So, you by no means have to fret about whether or not or not a particular performance will price you additional or require a plan improve.

OnPay’s easy pricing additionally provides you loads of bang to your buck. For a month-to-month price of $40 plus $6 per worker, you get full-service payroll, entry to advantages plans, worker self-service instruments, and important HR and staff administration options. As an added perk, OnPay gives white-glove setup and information migration help to get you began ― at no additional price to you. So, even when OnPay isn’t the most affordable or lacks international payroll providers, it nonetheless presents steadiness between pricing and options.

Pricing

OnPay has only one plan, with all options included. It prices $40 per thirty days plus $6 per worker, which is barely cheaper than QuickBooks Payroll’s starter tier ($50 plus $6 per worker per thirty days). Much like Gusto, OnPay presents extra HR functionalities than QuickBooks.

Nevertheless, OnPay doesn’t have a separate contractor-only plan. You must pay the identical fee as its full-service payroll tier, even when you solely must course of contractor funds. I like to recommend utilizing Sq. Payroll in order for you a QuickBooks Payroll different that gives a low-cost contractor bundle.

OnPay execs and cons

| Professionals | Cons |

|---|---|

|

|

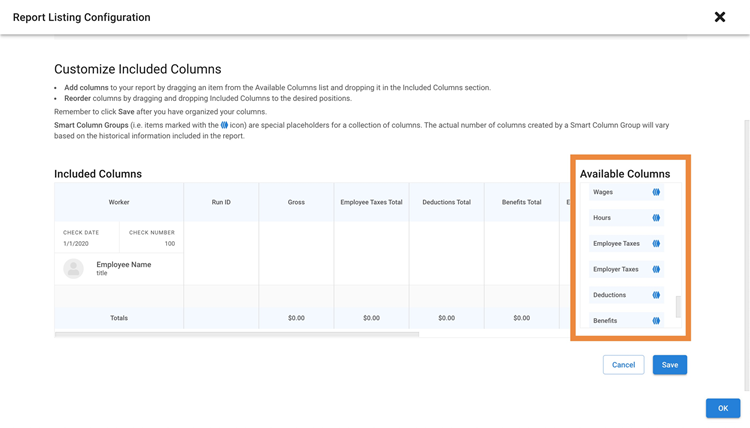

When to decide on OnPay over QuickBooks Payroll

OnPay made my record of the highest alternate options to QuickBooks Payroll due to the vary of core HR options that it gives. Along with its HR info system (HRIS) module to handle worker information and paperwork, you get a searchable firm listing and on-line org chart that robotically updates primarily based on adjustments to OnPay’s worker profiles.

I additionally respect its customizable day off insurance policies, which let you create as much as three accrual guidelines. This permits employees to earn PTO credit at completely different charges relying on varied elements like worker sort, tenure, and work location. Whereas QuickBooks additionally has customizable accrual insurance policies, it isn’t as versatile as OnPay’s.

Additional, creating payroll experiences is less complicated with OnPay. You may add or take away a column, drag and drop it to your required place, and use filters to pick gadgets. You may even add one among its collapsible “good column” teams, which include a number of columns of associated information, comparable to work hours and employer taxes. This gives fast entry to payroll data chances are you’ll must overview on-line experiences with out these columns taking an excessive amount of house on the report. With QuickBooks, you don’t get comparable customization choices.

Be taught extra about OnPay

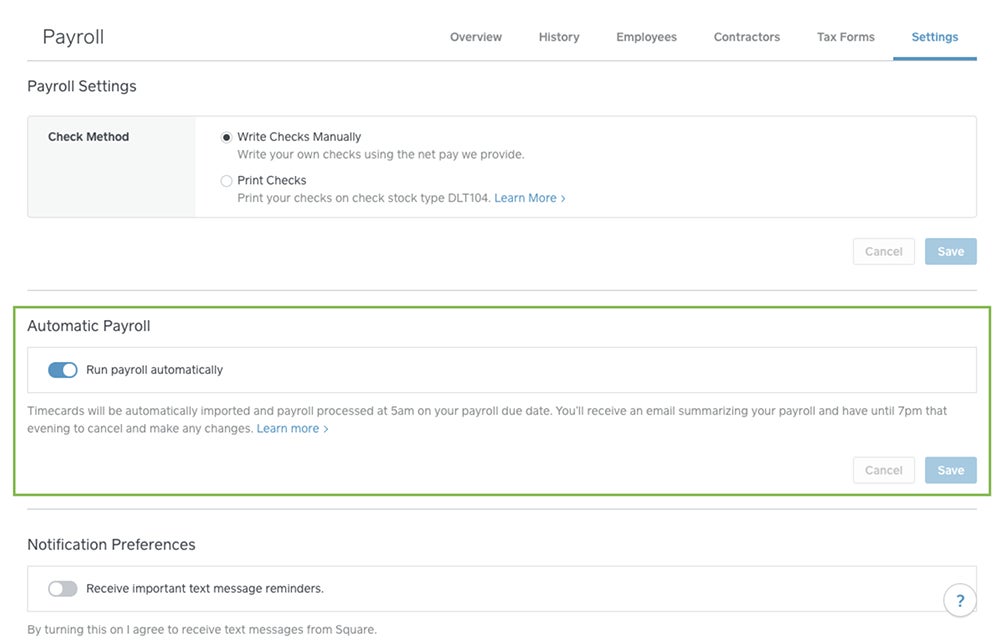

Sq. Payroll: Greatest for contractor funds

Sq. Payroll is an effective possibility when you’re searching for a QuickBooks Payroll different with an inexpensive contractor-only plan. It might not be as cost-efficient as its competitor, nevertheless it’s the most affordable on my record for a month-to-month price of solely $6 per employee. It consists of every little thing you’ll want to run payroll whereas staying authorized and compliant, like no-fee tax kind processing to your 1099s. And given the value, Sq. Payroll provides you loads of worth ― particularly in order for you an intuitive pay processing platform for you and your contractors.

Nevertheless, it lacks the excellent HR options and worldwide cost instruments that comparable payroll suppliers supply. It’s additionally greatest used with different Sq. merchandise, like Sq. POS. This lets you maximize its cost functionalities whereas leveraging the direct integration between its payroll and level of sale (POS) techniques for straightforward information transfers and worker tip or fee processing.

Pricing

With Sq. Payroll, you get two choices:

- Full-service payroll: $35 base price per thirty days plus $6 per worker per thirty days.

- Contractor-only payroll: $6 per employee per thirty days.

In comparison with the entire suppliers on my record, Sq. Payroll presents probably the most inexpensive full-service payroll and contractor-only payroll plans. It can save you extra with this QuickBooks Payroll different, offered you solely want primary HR instruments, comparable to easy new rent onboarding, scheduling, and time monitoring options.

Sq. Payroll execs and cons

| Professionals | Cons |

|---|---|

|

|

When to decide on Sq. Payroll over QuickBooks Payroll

In case you have a restaurant or retail store, utilizing Sq.’s merchandise can simplify your cost processes and operations. For instance, you should use Sq. On-line to handle your on-line retailer and upon getting a bodily retailer, get Sq. POS to simply accept funds and Sq. Payroll to course of workers payouts. Its advertising merchandise additionally assist you to construct shopper relationships via e mail and textual content advertising campaigns. Whereas QuickBooks might have a number of merchandise, these are targeted on cost and accounting options.

In contrast to QuickBooks Payroll, which doesn’t have a downloadable app, Sq. Payroll has separate apps for workers and employers. The app for workers features as a self-service device the place your workers can entry payslips and tax varieties, test schedules, get real-time messages, and clock in/out for work. In the meantime, the app for employers lets you import timecards, ship funds, and handle payroll.

By way of contractor payouts, you can even use the Sq. Payroll app to course of funds for contract employees. You may even pay them by guide test, direct deposit, or through the Sq. Money App. With the QuickBooks contractor funds plan, your cost possibility is just via direct deposits, which could be limiting, particularly if in case you have employees preferring to obtain their pay through paychecks.

Be taught extra about Sq. Payroll

Paychex Flex: Greatest for devoted payroll help

Paychex presents a variety of HR and pay processing merchandise for companies of all sizes. Its core payroll software program is Paychex Flex, and relying on the plan chosen, you additionally get primary to superior HR instruments. Paychex even presents a studying administration system (LMS) you could add to its payroll platform for a price. That is nice for conserving workers engaged whereas rising their abilities.

It additionally gives entry to devoted payroll specialists who can reply your payroll-related questions and help with payroll runs. This units Paychex Flex aside from QuickBooks Payroll and the others on my record. With a devoted specialist who is aware of your distinctive payroll and enterprise wants, it can save you time explaining your scenario and get solutions rapidly. Your devoted specialist may uncover pay and tax points you might have missed.

Pricing

What I don’t like about Paychex is its non-transparent pricing. You must name its gross sales staff to request a quote. And when you’re getting different instruments, like its time-tracking module, you’ll want to contact a separate staff to get pricing particulars. That is in contrast to QuickBooks Payroll, Gusto, and Sq. Payroll, which all record month-to-month charges on their web sites.

Paychex additionally presents completely different custom-priced packages relying on the dimensions of your corporation. It has a solopreneur tier and plans for firms with 50 to greater than 1,000 workers. For small companies with as much as 49 employees, it has three packages:

- Choose: Customized pricing

- Professional: Customized pricing

- Enterprise: Customized pricing

Whereas every plan consists of its personal set of options, lower-tier plans supply the choice to buy additional instruments, comparable to expense administration through Expense Wire, pre-employment screenings, recruiting and onboarding, and garnishment funds — a service that Gusto presents at no additional price. Even on the highest-tier plan, some instruments, comparable to worker advantages, time and attendance, studying administration, and HR analytics, can be found solely as paid add-ons.

Paychex Flex execs and cons

| Professionals | Cons |

|---|---|

|

|

When to decide on Paychex Flex over QuickBooks Payroll

Paychex Flex presents extra payroll help instruments than QuickBooks and different opponents. Along with its devoted payroll specialist, its Paychex Pre-check characteristic lets your workers overview their paychecks earlier than the scheduled pay day. This permits them to lift questions on lacking pay gadgets like time beyond regulation and, concurrently, lets you reduce cost errors and keep away from pricey payroll errors.

Like Sq. Payroll, Paychex Flex can also be possibility for processing payroll whereas on the go. You can begin pay runs through its cell app and proceed the place you left off in your laptop computer or desktop and vice versa.

And when you’re searching for a monetary wellness program, Paychex presents monetary training programs and short-term loans to your workers. It even has an intuitive revenue calculator that lets your employees decide if their retirement plan is on observe to fulfill their retirement objectives primarily based on the knowledge that they supply. Not one of the suppliers on my record, together with QuickBooks Payroll, have an identical retirement readiness calculator.

Be taught extra about Paychex Flex

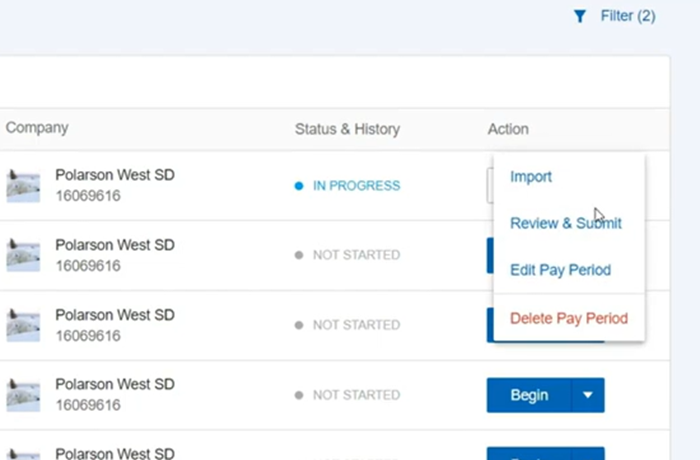

RUN Powered by ADP: Greatest for scalability

In the event you fear your corporation will outgrow QuickBooks Payroll, think about RUN Powered by ADP or ADP RUN in its place. It presents the full-service payroll, tax submitting providers, and compliance help that most of the greatest payroll software program bundle into their plans. ADP additionally has quite a lot of HR services and products that may meet the wants of small to massive companies, making it extremely scalable in comparison with QuickBooks and the opposite QuickBooks Payroll alternate options on my record (besides Paychex Flex).

If you need a small enterprise payroll system with nominal HR options, you can begin with ADP RUN. Its primary plan presents a greater vary of HR instruments than Paychex Flex and QuickBooks Payroll. If you need extra options or have a much bigger workforce, you may change to different merchandise like ADP Workforce, which is perfect for midsized to massive companies. You may also get ADP TotalSource, knowledgeable employer group (PEO) service that handles your day-to-day HR and payroll duties.

Pricing

ADP RUN is one other QuickBooks Payroll different that doesn’t record its pricing on its web site. You may get a quote by contacting its gross sales staff.

It has 4 plans:

- Important: Customized pricing

- Enhanced: Customized pricing

- Full: Customized pricing

- HR Professional: Customized pricing

Whereas lots of its HR options, comparable to studying administration and applicant monitoring, are solely out there in greater tiers, ADP RUN is best than Paychex Flex as a result of it solely costs additional for a handful of instruments, comparable to time monitoring, retirement and medical insurance plans, and employees’ compensation. Plus, with Paychex Flex, hiring and worker onboarding options are paid add-ons, even when you get a better plan.

RUN Powered by ADP execs and cons

| Professionals | Cons |

|---|---|

|

|

When to decide on RUN Powered by ADP over QuickBooks Payroll

In the event you want a variety of HR options, higher-tier ADP RUN plans include sturdy recruitment instruments, comparable to ZipRecruiter job postings, applicant monitoring, and background checks. You even get wage benchmark info that will help you entice certified candidates and gauge the competitiveness of your compensation bundle.

Along with its LMS, which helps you to assign and observe the completion of on-line programs, it presents entry to a sexual harassment prevention coaching program you could readily deploy to workers. And that’s all on prime of the in-app compliance alerts and HR help you get from ADP’s staff of HR professionals who will help you navigate sophisticated HR points. You may even entry advertising instruments and get authorized help through Upnetic’s advisors and authorized providers.

Additional, ADP RUN makes paying workers through paychecks simpler. It could possibly put together the paychecks, stuff and seal them into envelopes, after which ship these to your workplace in time so that you can distribute to workers. It even presents test signing providers and gives paychecks with 10 superior fraud safety options — a performance that QuickBooks and the others on my record don’t present.

Be taught extra about RUN Powered by ADP

To see the way it compares with QuickBooks Payroll, learn our ADP vs QuickBooks Payroll article.

Must you select QuickBooks Payroll or another?

QuickBooks Payroll is a worthwhile funding for a lot of companies. Whereas it does price greater than opponents, QuickBooks presents an easy-to-learn payroll platform with all of the important HR instruments you want. In the event you already use the QuickBooks ecosystem, the marginally excessive price is price it for the benefit of use. Plus, the direct integration between QuickBooks merchandise minimizes the danger of getting information errors as a result of it doesn’t require guide inputs.

Nevertheless, relying on the payroll software program options you’re searching for, chances are you’ll want to seek out a substitute for QuickBooks Payroll. In the event you actually need HR instruments, as an example, different suppliers supply extra options and extra worth. Or, if you’ll want to make funds to employees in different international locations, you’ll have to seek out another, as QuickBooks doesn’t do international payroll.

QuickBooks Payroll different steadily requested questions (FAQs)

Which software program is greatest to make use of as a QuickBooks Payroll different?

Gusto, OnPay, and Sq. Payroll are three of my prime alternate options to QuickBooks Payroll. Each Gusto and OnPay supply a feature-rich payroll platform with the core HR options you’ll want to handle workers. Alternatively, Sq. Payroll has a contractor-only plan that’s almost as inexpensive as QuickBooks’ contractor funds bundle.

How ought to I change from QuickBooks Payroll to a different supplier?

Altering software program suppliers entails conducting product analysis, evaluating the choices out there, and guaranteeing that the QuickBooks Payroll different you choose has the important thing options you want at a value inside your finances. Subsequent, you arrange your account with the brand new supplier, add your information into the brand new system, and carry out take a look at payroll runs to ensure accuracy. Then, you create and implement a communication and coaching plan so your workers know what to anticipate and when their new consumer coaching periods will occur.

Which different to QuickBooks Payroll is probably the most cost-effective?

Based mostly on my record of greatest QuickBooks Payroll alternate options, Sq. Payroll is probably the most cost-effective. It has probably the most inexpensive plans for operating worker payroll and processing contractor-only funds.

Methodology

Sometimes, I exploit a rubric and my professional evaluation to match software program choices. Nevertheless, for this text, I leveraged my decade-long experience in human sources and 6 years of expertise reviewing HR and payroll software program to find out the perfect alternate options to QuickBooks Payroll. I began my analysis by inspecting 9 standard payroll techniques for small companies. These choices embrace:

- Gusto

- SurePayroll

- Paychex Flex

- ADP RUN

- Rippling

- Patriot Payroll

- Wave Payroll

- OnPay

- Sq. Payroll

Then, I in contrast every software program supplier’s pricing, buyer help choices, and normal ease of use. I even checked consumer critiques on dependable on-line websites like G2 and Capterra. I additionally appeared for key payroll and HR options that QuickBooks Payroll lacks and areas the place its opponents excel. After a radical overview, I narrowed my record right down to the highest 5 choices, specializing in platforms which might be typically straightforward to make use of, supply extra HR options, and are extra inexpensive than QuickBooks Payroll.

If you wish to find out about our common analysis course of, try our payroll software program overview methodology web page.

========================

AI, IT SOLUTIONS TECHTOKAI.NET