Apple (NASDAQ: AAPL) revealed its new computerized reasoning highlights named “Macintosh Insight” at its Overall Designers Gathering half a month prior. The features incorporate text age and synopsis across applications, high-level simulated intelligence helped photograph altering capacities, and a lot more astute and all the more impressive Siri. It additionally incorporates outsider administrations like ChatGPT for further developed prompts.

What makes Apple Insight so convincing is how much-simulated intelligence handling it does on the gadget. Rather than taking your question, sending it to a server alongside any important information, trusting that the server will handle your solicitation, and afterward downloading the outcomes to your gadget, the whole cycle occurs on your iPhone, Macintosh, or iPad. For further developed inquiries requiring a bigger establishment model, Apple utilizes its servers and framework called Private Cloud Figure, which safeguards clients’ security.

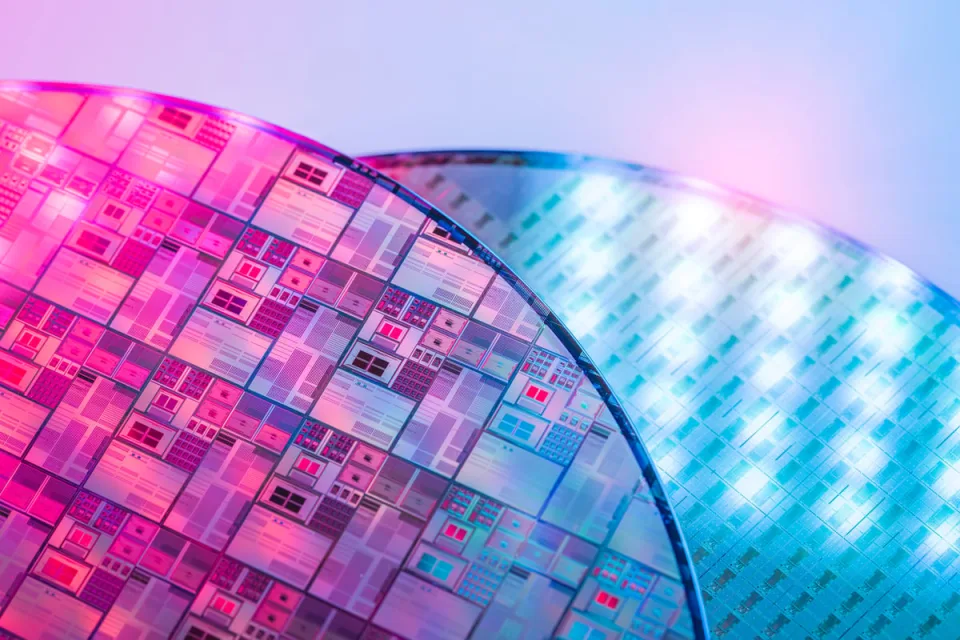

Both of those improvements could be a significant win for perhaps one of Apple’s greatest providers. Since these new elements run on Apple-planned silicon, chip foundry Taiwan Semiconductor Assembling Co. (NYSE: TSM) could see an expansion in orders because of Apple Knowledge. Furthermore, as Apple drives how in on-gadget man-made intelligence is handled, it could push other gadget creators to purchase further developed chips from TSMC also.

Driving computerized reasoning to the brink

With Macintosh Knowledge, Mac is introducing the following period of man-made brainpower known as edge computer-based intelligence (when information and calculations are handled straightforwardly on the end gadget, for this situation a cell phone, tablet, or PC).

To handle artificial intelligence questions on gadgets, however, the gadgets should be skilled. That implies equipment that is even only a couple of years old probably won’t have the option to deal with simulated intelligence demands too as more up-to-date gadgets can, if they might deal with them by any means. Apple, for instance, is restricting Apple Knowledge highlights to the iPhone 15 Expert, iPhone 15 Master Max, and the impending iPhone 16 gadgets. (Note the restricting variable here is how much momentary memory, or Smash, is on the gadget, not the actual processors.)

Subsequently, Apple could areas of strength for see from clients anxious to update their telephones throughout the following couple of years as Apple Insight highlights are carried out around the world. Furthermore, more iPhone deals imply more interest in TSMC’s chips.

Yet, TSMC doesn’t simply supply chips for Apple. It fabricates most of the chips on the planet, representing more than 60% of the market. That scale gives it an enormous upper hand over more modest foundries, as it can put more cash into Research and development to foster further developed cycles to print all the more remarkable and energy-proficient chips. That guarantees it continues to exist for clients like Apple that are searching for driving edge chips, and it draws in a greater amount of their business. It additionally assists TSMC with attracting new clients as developments like edge man-made intelligence push organizations to embrace new chip plans.

The Apple cloud is simply getting everything rolling

To help outsiders enormous language models (LLMs) and its own further developed LLM, Apple made the Private Cloud Figure (PCC). The framework utilizes Apple servers that likewise send the tech titan’s chip plans.

Apple mustn’t be utilizing the stage to prepare man-made intelligence models. Utilizing PCC to handle information and calculations would require more figure power than what’s accessible on buyer gadgets. The main execution is sending prompts to ChatGPT.

There’s a ton of potential for Apple to develop its server farm limit as it accomplices additional organizations and engineers hoping to incorporate their simulated intelligence administrations with Apple’s foundation. At the point when the organization reported its association with OpenAI’s ChatGPT, carrying more accomplices to the stage not long from now said it was working. On the off chance that Apple pushes engineers to utilize PCC, it could additionally expand Apple’s interest in TSMC’s administrations. It additionally offers one more way for Apple to create pay for engineers.

There’s a long runway for Apple to develop simulated intelligence highlights through outsider combinations. Simply consider the remarkable development of the Application Store throughout recent years. Comparable development would be an aid for both Apple and TSMC.

Making a $1 trillion semiconductor organization

TSMC as of now has a market cap of around $900 billion. All things being equal, shares look underestimated at the present cost given the development likely prodded by proceeded with interest for simulated intelligence chips.

The stock exchanges for around 27x forward income gauges, which is a more than fair cost to pay. It ought to have the option to develop its income quickly enough to legitimize that cost as interest for further developed chips upholds its top-line development and works on its working edges. Examiners expect income will increment more than 25% one year from now.

A solid iPhone redesign cycle throughout the following couple of years, gradual interest from Apple’s new server farms, and the general push toward edge processing all favored TSMC’s proceeded with development. Its upper hand in making the most developed, strong, and energy-proficient chips will work well for it throughout the following couple of years. It’s inevitable before the organization beats a $1 trillion market cap.

Would it be advisable for you to put $1,000 in Taiwan Semiconductor Assembling at present?

Before you purchase stock in Taiwan Semiconductor Assembling, think about this:

The Diverse Numb-skull Stock Counsel expert group just distinguished what they accept are the 10 best stocks for financial backers to purchase now… and Taiwan Semiconductor Assembling wasn’t one of them. The 10 stocks that got it done could create beast returns before very long.

Consider when Nvidia made this rundown on April 15, 2005… if you contributed $1,000 at the hour of our proposal, you’d have $751,670!*

Stock Counselor gives financial backers a simple-to-follow outline for progress, remembering direction for building a portfolio, normal updates from examiners, and two new stock picks every month. The Stock Guide administration has more than quadrupled the arrival of the S&P 500 since 2002*.