Over the previous few months, so many modifications to the Company Transparency Act (CTA) have made it troublesome to not sweep. With all of the plot turns and the flip-flops of the courtroom, this saga looks like watching a docu-so-so. Whereas the remainder of the world is maintaining with the Kardashians, you might need to sustain with the CTA, as actuality for this panorama remains to be growing.

Are native US companies nonetheless anticipated to submit a BOI report?

No, native US companies and US residents should not have to submit the BoI report primarily based on an interim choice. Nonetheless, sure corporations nonetheless want to do that, as mentioned in additional element under. The interim judgment is provisional and may solely depend on the courts till the courts subject a last ruling, which is anticipated to be made obtainable to the general public by the tip of 2025.

What’s the CTA?

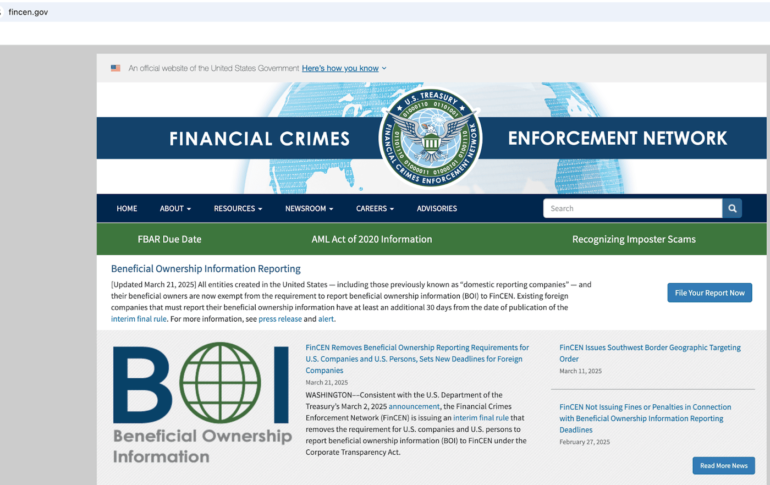

The CTA was established to forestall using nameless monitoring corporations for cash laundering, tax evasion and different unlawful functions. This requires particular entities to report their Boi to the Fincen. From the latest judgment, this info is then consolidated in a repository of information just for international entities or people who personal or management corporations that work in the US.

The Fincen is a Bureau within the US Division of Treasury that helps shield the integrity of the US monetary system. Fincen has the duty of investigating monetary crimes by accumulating and analyzing monetary knowledge. It administers regulatory compliance with monetary establishments and helps legislation enforcement by sharing the monetary knowledge collected.

Who ought to adjust to the CTA?

When it comes to earlier CTA laws, many small companies working within the US can be topic to victory reporting necessities. When it comes to Fincen’s most up-to-date announcement, solely entities are outlined as ‘Overseas Reporting Enterprises’ to finish BOI reporting.

A international reporting enterprise is outlined as any company, restricted legal responsibility firm (LLC) or different related entity

- Fashioned below the legal guidelines of a international land; and

- Registered to do enterprise within the US.

Though the US Treasury Division has introduced that it’s going to now not implement the CTA’s helpful possession for home companies, the next is relevant:

- Overseas entities registered to do enterprise within the US earlier than March 21, 2025, should submit BOI stories no later than 30 days from that date.

- Overseas entities registered to do enterprise within the US on or after March 21, 2025, have 30 calendar days after the efficient date of registration to submit an preliminary Boi report.

Fines for non-compliance

Entities that don’t meet the CTA’s reporting necessities could face important fines.

- Civil fines: The offense lasts as much as $ 592 a day for every day.

- Legal fines: As much as $ 10,000 and imprisonment for as much as two years because of willful offenses.

Frequently requested questions (questions)

Are small companies exempt from BOI reporting below the CTA?

Sure. Based mostly on the laws on the time of this publication, companies in possession and operation (massive or small) should not have to submit helpful info stories for possession.

Who ought to submit the CTA reporting?

Overseas corporations working within the US should submit BOI stories below the CTA.

How do you place a BOI report in?

Boi stories are submitted to boir.org. Reporting necessities proven on the web site could take time to replicate current legislative updates.

How usually ought to the submitting be up to date?

Entities should replace their BOI stories inside 30 days of any change within the reported info to make sure that Fincen’s data stay correct.

(Tagstotranslate) Company Tax (T) Company Transparency (T) Company Transparency Act (T) CTA compliance

========================

AI, IT SOLUTIONS TECHTOKAI.NET