Cryptocurrencies are not confined to the realm of tech lovers — they’ve turn out to be a sensible fee possibility for companies of all sizes. Within the U.S. alone, greater than 2,000 companies now settle for cryptocurrency funds, with main manufacturers like Starbucks, Dwelling Depot, and Tesla main the cost.

For tech-savvy enterprise house owners and entrepreneurs, accepting crypto funds can open doorways to a broader buyer base, scale back transaction prices, and strengthen fee safety. Nevertheless, diving into this new world of funds comes with its personal set of issues and challenges.

Key takeaways:

|

This information will stroll you thru the important steps to just accept crypto funds confidently and seamlessly in your enterprise.

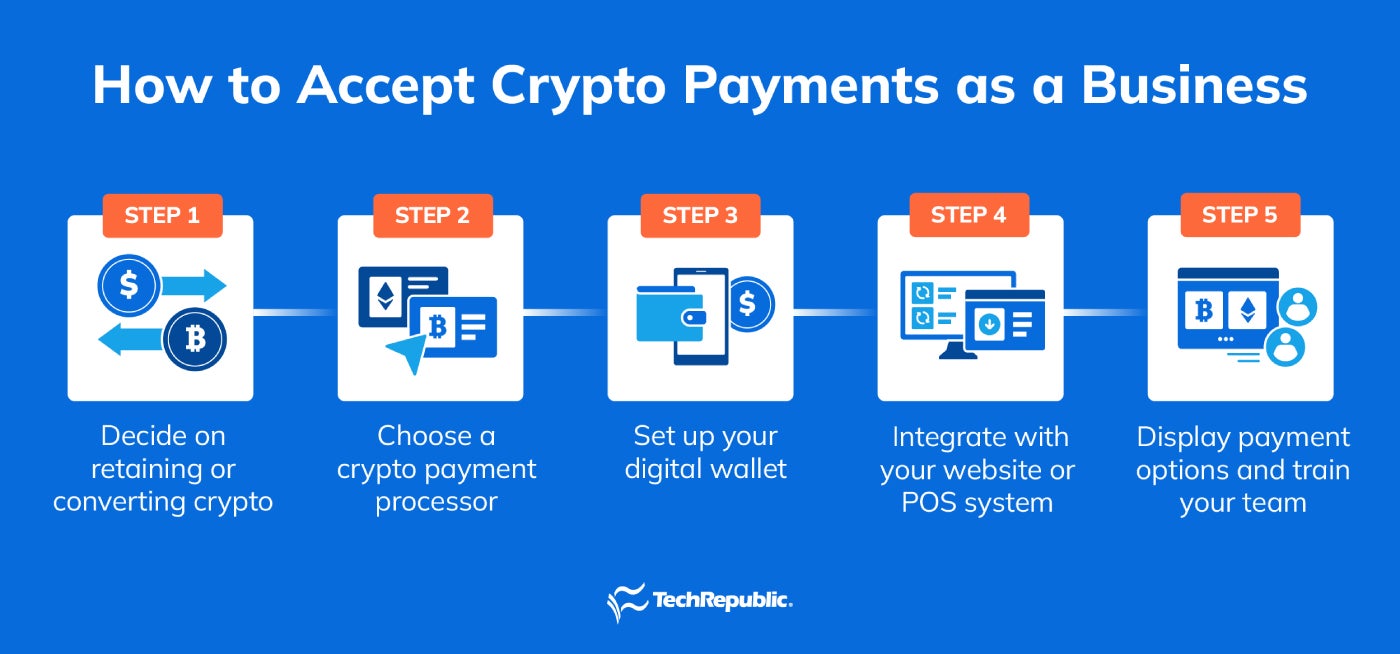

How one can settle for crypto funds as a enterprise

Accepting crypto funds could be simple when damaged down into a number of clear steps. Right here’s how one can get began.

-

Determine on retaining or changing crypto

Earlier than you start, resolve the way you need to deal with the cryptocurrency you obtain:

- Retain crypto: Maintaining funds in cryptocurrency can function an funding alternative however carries the danger of worth volatility. You’ll want a safe digital pockets and probably a plan for managing tax implications.

- Convert to fiat: Robotically changing crypto into fiat forex (e.g., USD, EUR) ensures stability and simplifies accounting. Many crypto fee processors provide computerized conversion options.

When making this choice, contemplate your enterprise objectives, danger tolerance, and native laws. This selection may even information your collection of a fee processor.

-

Select a crypto fee processor

A crypto fee processor simplifies transactions and integrates crypto funds along with your current programs. In style choices embrace BitPay, Coinbase Commerce, and NOWPayments. For different choices, examine our record of the very best crypto fee gateways.

When selecting a processor, consider these options:

- Supported cryptocurrencies: Guarantee it helps the cash you need to settle for (e.g., Bitcoin, Ethereum, USDT).

- Integration choices: Verify for plugins or APIs for seamless integration with platforms like Shopify, WooCommerce, or customized programs.

- Charges: Examine transaction charges, withdrawal charges, and different related prices.

- Developer instruments: Search for detailed API documentation, SDKs, and developer assist for customized integrations.

-

Arrange your digital pockets

A digital pockets is crucial for receiving and storing cryptocurrency. There are two main choices:

- Custodial wallets: These are wallets managed by third events (e.g., Coinbase, Binance). Custodial wallets are user-friendly and safe however depend on the service supplier for personal key administration. Most net wallets are custodial wallets.

- Non-custodial wallets: These wallets present full management of personal keys (e.g., Ledger, MetaMask) and are perfect for companies prioritizing safety however require technical data to arrange and handle. Non-custodial wallets could also be scorching or chilly–scorching wallets, that are linked to the web, making them extra accessible, or chilly wallets, that are saved offline, making them safer. Some choices for warm wallets are desktop wallets, cell wallets, and net wallets. For chilly wallets, the go-to possibility is {hardware} wallets.

For optimum safety, contemplate {hardware} wallets for offline storage of crypto belongings.

-

Combine along with your web site or POS system

Integrating crypto fee choices ensures a seamless transaction expertise in your prospects, whether or not on-line or in-store.

- For e-commerce: Most crypto fee processors provide plugins for platforms like WooCommerce, Magento, and Shopify. For customized setups, use APIs to combine immediately along with your web site’s backend.

- For bodily shops: Use QR codes to permit prospects to scan and pay on to your pockets or processor. Many POS programs now provide crypto assist or could be upgraded with add-ons like Clover’s Crypto Integration or Shopify POS for bodily shops.

-

Show fee choices and prepare your crew

Clearly show that you simply settle for crypto funds in your web site or bodily retailer to tell prospects. Guarantee your crew is skilled on how you can course of these transactions, deal with buyer questions, and troubleshoot frequent points.

- Visibility: Prominently showcase crypto fee choices in your web site, checkout pages, and bodily retailer signage. For instance, Add a “Pay with Crypto” button in your web site.

- Group coaching: Prepare workers to handle crypto transactions, confirm fee confirmations on the blockchain, and handle buyer inquiries. Guarantee they’ll resolve points like incorrect quantities despatched or delayed confirmations.

Advantages of accepting crypto funds

Accepting cryptocurrency as a fee methodology can present quite a few benefits for companies. Listed here are the important thing advantages.

- Decrease transaction charges: Crypto transactions typically have considerably decrease processing charges than bank cards or conventional fee programs, saving your enterprise cash, particularly for high-volume or worldwide transactions. Whereas card transactions can value round 2% to 4% per transaction, crypto transactions could be as little as 0% to 2% per transaction.

- Quicker funds: Not like conventional banking programs, crypto funds are processed virtually immediately, whatever the sender’s or recipient’s location. This could enhance money move and scale back delays in receiving funds.

- International accessibility: Cryptocurrency will allow your enterprise to just accept funds from prospects worldwide with out coping with trade charges or worldwide switch charges; that is notably advantageous for e-commerce and world enterprises. Nevertheless, bear in mind there are nonetheless a number of international locations like China the place cryptocurrencies are unlawful.

- Fraud safety: Blockchain expertise ensures that crypto transactions are safe, irreversible, and clear. This reduces the danger of chargebacks and fraud, providing companies peace of thoughts.

- Attracting tech-savvy prospects: Accepting crypto can differentiate your enterprise and attraction to a rising demographic of tech-savvy prospects preferring various fee strategies in an more and more cashless society.

- Future-proofing your enterprise: As cryptocurrency adoption continues to develop, integrating it into your fee choices positions your enterprise on the forefront of innovation, able to adapt to rising tendencies in digital finance.

Drawbacks of accepting crypto funds

Whereas accepting cryptocurrency provides benefits, it’s essential to think about the potential drawbacks.

- Worth volatility: Cryptocurrency costs can fluctuate considerably inside quick intervals. This volatility poses a danger for companies holding crypto, because the fee worth can lower earlier than conversion to fiat forex.

- Regulatory uncertainty: Cryptocurrencies are topic to evolving authorized and regulatory frameworks that fluctuate by nation. Companies accepting crypto should keep up to date on compliance necessities, reporting obligations, and tax implications.

- Restricted buyer base: Regardless of rising adoption, the variety of prospects preferring to pay with crypto stays comparatively small, particularly outdoors tech-savvy or area of interest markets. This limits its widespread applicability for a lot of companies.

- Complicated setup and upkeep: Integrating crypto funds requires technical data and assets, together with choosing the proper processor, establishing wallets, and making certain safe storage. Companies additionally must replace programs usually to keep up compatibility and safety.

- Transaction prices for conversions: Whereas crypto transactions typically have low processing charges, changing cryptocurrency to fiat usually incurs extra expenses resembling a “fuel price.” These conversion charges can erode among the value financial savings.

Tax and authorized issues for accepting crypto funds

Accepting cryptocurrency funds introduces particular tax and authorized obligations it’s essential to handle for your enterprise to stay compliant. Right here’s what to bear in mind.

Tax implications

Cryptocurrency transactions are taxable in lots of jurisdictions. The particular guidelines fluctuate, however frequent necessities embrace:

- Earnings reporting: Cryptocurrency obtained as fee is taken into account taxable revenue, normally primarily based on its honest market worth on the time of the transaction.

- Capital positive aspects tax: When you retain crypto and later promote or trade it, it’s possible you’ll incur capital positive aspects or losses relying on its change in worth.

- Gross sales tax: In some areas, companies should gather and remit gross sales tax on items or providers bought through crypto, simply as with conventional funds.

Keep detailed data of all transactions, together with the date, worth on the time of receipt, and any subsequent conversion particulars, to simplify tax reporting. Think about instruments like CoinTracking or CryptoTrader.tax for managing tax reporting.

Regulatory compliance

Accepting crypto funds additionally entails making certain compliance with regulatory necessities. Completely different governments and regulatory our bodies have various guidelines for cryptocurrency use:

- Know Your Buyer (KYC) and Anti-Cash Laundering (AML) laws: Some jurisdictions require companies to adjust to KYC and AML legal guidelines when accepting crypto, notably for giant transactions.

- Licensing necessities: Sure areas might require a license to conduct cryptocurrency transactions or use particular fee processors.

- Cryptocurrency Safety Commonplace: Firms that use, retailer, and settle for cryptocurrencies should observe a set of necessities much like the Cost Card Trade Knowledge Safety Commonplace (PCI DSS). When you additionally settle for card funds, you’ll need to keep up PCI compliance and CSS compliance.

Seek the advice of native regulatory tips to make sure compliance and keep away from penalties.

Recordkeeping

Correct documentation is crucial for tax and authorized functions. Use instruments or software program to trace crypto transactions, together with pockets addresses, transaction IDs, and fiat conversions. Many crypto fee processors provide built-in reporting options to assist with recordkeeping and compliance.

Worldwide transactions

Cryptocurrency is borderless, however worldwide funds might set off extra issues.

- Export/import legal guidelines: Confirm that crypto funds adjust to worldwide commerce laws within the international locations the place you do enterprise.

- International trade guidelines: Concentrate on any forex management laws that would impression crypto conversions.

Authorized uncertainty

Cryptocurrency laws are evolving. To make sure ongoing compliance, keep knowledgeable about adjustments in legal guidelines and tips in your working areas. Additionally, usually seek the advice of with authorized and tax professionals who concentrate on cryptocurrency.

Examples of companies efficiently accepting crypto funds

Cryptocurrency is not a distinct segment fee methodology, with quite a few companies throughout industries embracing it. Listed here are notable examples.

- Overstock: This fashionable on-line retailer grew to become the first main retailer to just accept Bitcoin in 2014, setting a precedent for large-scale crypto adoption in ecommerce. The corporate stays a pacesetter in accepting a number of cryptocurrencies at this time; at the moment, it accepts all types of cryptocurrencies.

- Printemps: This iconic French division retailer chain made headlines because the first in Europe to just accept cryptocurrency funds. Prospects must have the Binance app, they usually can select to pay utilizing any cryptocurrency on the platform.

- Subway: This world fast-food restaurant chain was one of many earliest adopters of Bitcoin in 2013, enabling prospects to purchase sandwiches with crypto at choose areas. This transfer showcased the potential of digital currencies within the meals and beverage business.

- Starbucks: As one of many largest world chains to just accept cryptocurrency, Starbucks integrates crypto funds within the U.S.

- Crypto Actual Property: This actual property market facilitates property purchases worldwide utilizing cryptocurrency. From luxurious houses to industrial properties, Crypto Actual Property demonstrates how crypto can streamline high-value transactions.

Continuously Requested Questions (FAQs)

Learn the solutions to frequent questions on how you can settle for crypto funds.

What’s crypto?

Cryptocurrency, typically merely referred to as crypto, is a type of digital forex secured by cryptography and powered by blockchain expertise, a decentralized ledger maintained by a worldwide community of computer systems. Not like conventional cash issued by governments (fiat forex), cryptocurrencies function independently of any central authority.

Bitcoin, the primary and most well-known cryptocurrency, paved the way in which for 1000’s of others, together with Ethereum, Litecoin, and stablecoins like USDT. These currencies allow peer-to-peer transactions, typically with decrease charges and quicker processing instances than conventional fee strategies. This mixture of decentralization, safety, and effectivity makes cryptocurrency a beautiful fee possibility for contemporary companies.

Which crypto is essentially the most accepted at this time?

Bitcoin is essentially the most extensively accepted cryptocurrency as a consequence of its first-mover benefit and world recognition. Many companies additionally settle for Ethereum, Litecoin, and stablecoins like USDT and USDC for his or her reliability and decrease volatility.

The place is Bitcoin accepted at this time?

Bitcoin is accepted by numerous companies, together with main retailers like Overstock, eating places resembling Subway, and world chains like Starbucks. It’s additionally generally used for on-line providers, donations, and even actual property transactions.

How can I settle for Bitcoin funds?

To simply accept Bitcoin funds, arrange a Bitcoin pockets and select a crypto fee processor to deal with transactions. Combine the processor into your web site or POS system to allow seamless buyer funds.

How safe are crypto funds for companies?

Crypto funds are extremely safe as a consequence of blockchain’s immutable nature, however companies should use multi-signature wallets and sturdy cybersecurity protocols to forestall hacking or fraud.

What are Layer 2 options, and why are they essential for crypto funds?

Layer 2 options, like Bitcoin’s Lightning Community or Ethereum’s Optimism, enhance transaction pace and scale back prices by processing funds off the principle blockchain.

========================

AI, IT SOLUTIONS TECHTOKAI.NET